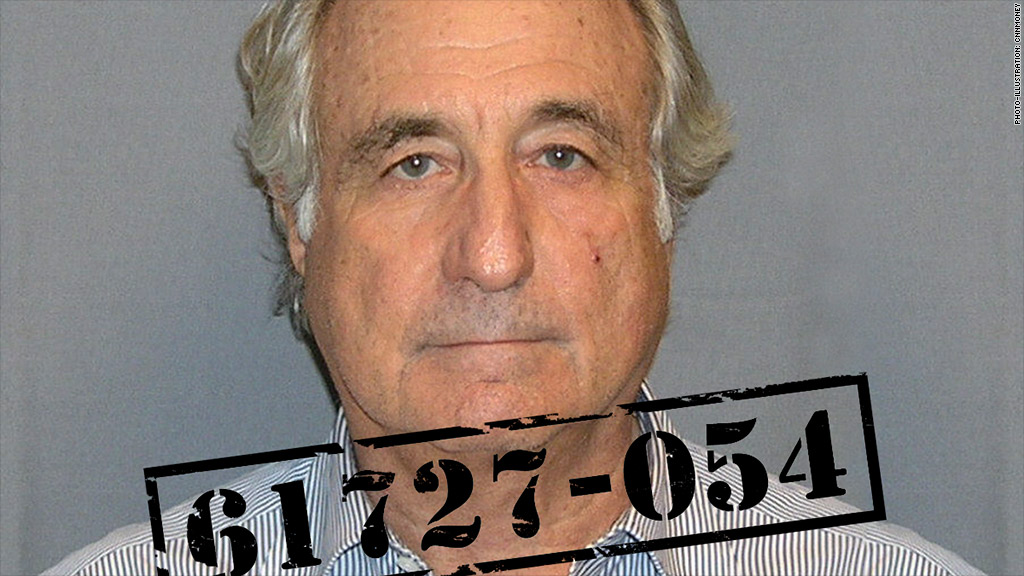

Berard Madoff: The Madoff Hustle

‘The

closer you look, the less you see’ is a great line for a magic trick, but an

even better line for a fraudster, and in this case, Bernard Madoff nailed it. In

his $65billion Ponzi scheme he ruined thousands of lives, from small time

investors to sophisticated money managers in what is the largest stock fraud in

history. So how did he do it? Once Madoff managed to revive his scheme, it

required a constant influx of additional funds. On its surface, the fraud looked

real enough to attract interest from new investors to help pay off client’s

doubts and make the scheme look profitable for everyone.

So

what went wrong? IT WAS A SCAM PEOPLE! Even for me, a young upcoming financial

student this fraud sounds ludicrous, how does a man of Madoff’s background not

only convince over 1000 wealthy people to invest but also manage to nutmeg

regulators? Unbelievable tekkers if you ask me. Some could argue that Madoff

was a trustworthy person and a huge credible man, promising returns of around

10% annually, which isn’t much, but is steady. Others could argue that because

of the steady return, Madoff could have a source for insider information to

help beat the market consistently. I

would argue that all people did was dump money in, do no due diligence and

count their money, why did they think it was plausible?

In

my opinion, the fault is not with Madoff, rather with the investors who didn’t

look beyond the promised rate of return and were gimmicked into this

personification of wealth. Some of Madoff’s investors had been investing in his

fraud for 21 years and as a result lost everything. I feel that through

investing in one particular stock makes these people very vulnerable, I say

‘people’ because most weren’t real investors rather people wanting a good

return.

In

my opinion, the fault is not with Madoff, rather with the investors who didn’t

look beyond the promised rate of return and were gimmicked into this

personification of wealth. Some of Madoff’s investors had been investing in his

fraud for 21 years and as a result lost everything. I feel that through

investing in one particular stock makes these people very vulnerable, I say

‘people’ because most weren’t real investors rather people wanting a good

return.

Portfolio

theory suggests that it is possible to construct an "efficient

frontier" of optimal portfolios, offering the maximum possible expected

return for a given level of risk. The theory suggests that it is not enough to

look at the expected risk and return of one particular stock, which is what

most investors did in Madoff case. If the investors were to invest in more than

one stock, the investor can reap the benefits of diversification, particularly

a reduction in the riskiness of the portfolio. Therefore, not putting their

eggs in one basket and risking all of their investments falling at once. If

they were to have created a portfolio of shares, investors wouldn’t have lost

everything, rather just one stock, which is what I would have done as an

investor.

The

real scam in this is market manipulation, an inefficient market, which

potentially could affect investor confidence in the future. The regulators in

my opinion were responsible for the colossal amount of the scandal. Tighter

regulations need to be put in place to prevent Ponzi schemes from ever

happening through more thorough searches.

Seven

years on from the scandal, it looks as though the majority of Madoff’s victims

are going to get a big pay-out (Popken, 2015) . I’m guessing along with his houses,

they also sold Madoff’s winter clothes; he won’t need them in prison.

Until

next time, I leave you with a quote from Harry Houdini, ‘My professional life

has been a constant record of disillusion, and many things that seem wonderful

to most men are the every-day commonplaces of my business.’

Leave

a comment if you have something to add, whether agree or disagree!

No comments:

Post a Comment